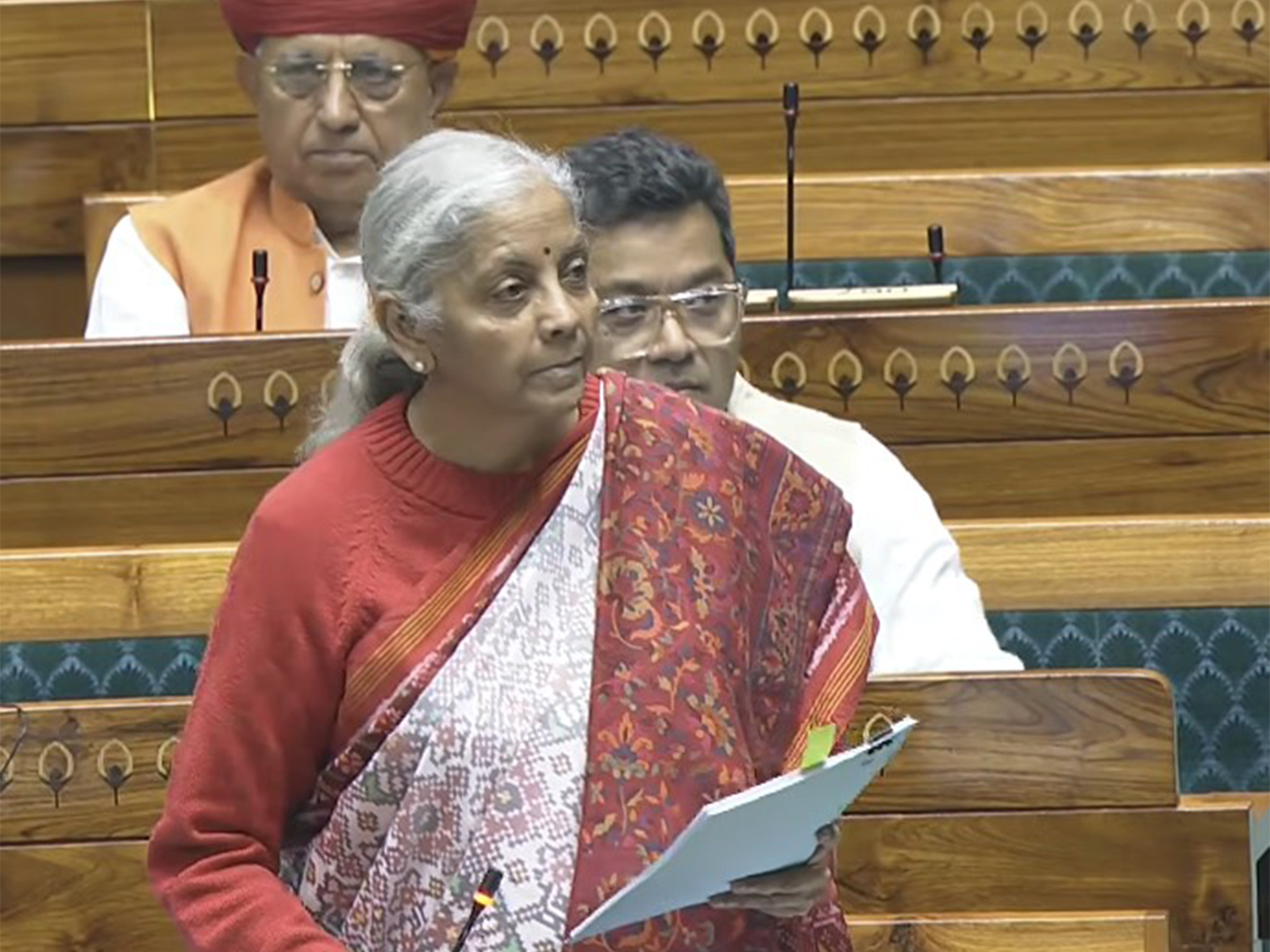

New Delhi [India], December 16 (ANI): Finance Minister Nirmala Sitharaman on Tuesday introduced the Insurance Laws (Amendment) Bill, 2025, titled “Sabka Bima Sabki Raksha”, in the Lok Sabha, aiming to strengthen policyholder protection, deepen insurance penetration and accelerate the growth of the insurance sector in the country.

The Bill seeks to amend key legislations, including the Insurance Act, 1938, the Life Insurance Corporation Act, 1956, and the Insurance Regulatory and Development Authority of India (IRDAI) Act, 1999. The proposed amendments are aligned with the government’s long-term vision of achieving ‘Insurance for All by 2047’ and improving ease of doing business in the sector.

A major highlight of the Bill is the proposal to raise the Foreign Direct Investment (FDI) limit in Indian insurance companies from the existing 74 per cent to 100 per cent. The government said the move is intended to attract stable, long-term foreign capital, facilitate technology transfer, and enhance insurance penetration and social security coverage across the country.

To strengthen consumer protection, the Bill proposes the establishment of a Policyholders’ Education and Protection Fund. The fund will focus on enhancing insurance awareness and safeguarding the interests of policyholders. In a significant regulatory empowerment, IRDAI is proposed to be granted the authority to disgorging wrongful gains, enabling the regulator to recover illegal or unfair gains made by insurers and intermediaries.

The Bill also provides a legal framework for the creation and effective use of digital public infrastructure in the insurance sector, with a focus on securing and protecting policyholder data. This is expected to support innovation while ensuring data privacy and cybersecurity.

In a move aimed at easing business operations and ensuring uninterrupted customer services, the Bill proposes one-time registration for insurance intermediaries. Further, the threshold for seeking IRDAI approval for the transfer of shares in insurance companies is proposed to be raised from the current 1 per cent to 5 per cent of paid-up equity capital.

The reinsurance sector is set to receive a major boost, with the proposed reduction in the Net Owned Fund requirement for foreign reinsurers from Rs 5,000 crore to Rs 1,000 crore. This is expected to facilitate the entry of more global reinsurers and enhance domestic reinsurance capacity.

The Bill also provides greater operational autonomy to state owned, the Life Insurance Corporation of India (LIC), allowing it to set up zonal offices and align its overseas operations with the laws and regulations of respective jurisdictions.

To improve regulatory governance, the amendments in the bill propose the introduction of a Standard Operating Procedure (SOP) for regulation-making under the IRDAI Act. Additionally, a transparent and rational framework for levying penalties is proposed, with clearly defined factors to guide fair imposition.

The Bill is expected to expand insurance coverage, bring more citizens under the insurance security net, and encourage the entry of more insurers, agents and intermediaries, thereby driving faster growth while ensuring stronger protection for policyholders. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages