New Delhi [India], July 10 (ANI): Union Finance Minister Nirmala Sitharaman emphasized that the loan recovery practices of Non-Banking Financial Companies (NBFCs) must be fair, respectful, and empathetic, and must strictly align with the Reserve Bank of India’s (RBI) Fair Practices Code.

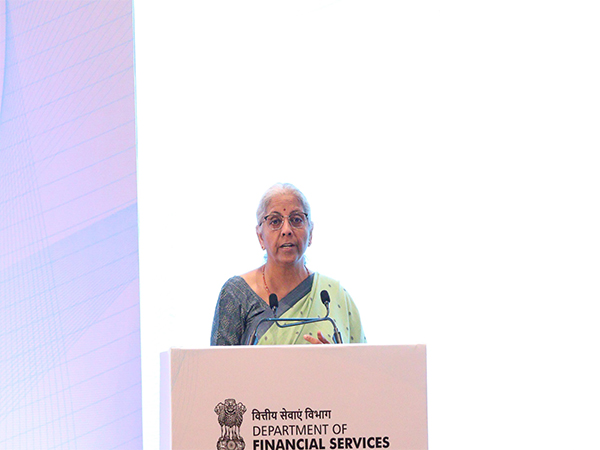

Speaking at the NBFC Symposium 2025 held in New Delhi on Wednesday, the minister urged NBFCs to avoid harsh recovery measures, especially in cases involving small loan amounts, and reminded them of the importance of customer dignity.

“Recovery practices of NBFCs must be fair, empathetic and respectful, in strict accordance with the RBI’s Fair Practices Code,” Sitharaman said.

She noted that sometimes media reports highlight harsh recovery actions taken for very small loan amounts like Rs 500.

“Sensationalized reporting in the media, which they are right in reporting. I don’t fault the media at all on this. Where harsh measures are taken for recovery of a 500 rupee. heartbreaking stories come out,” she said.

The minister added, “I know for you it’s important and it’s part of your duty, but it’s not part of your duty to be heartless. You need to have better Fair Practices Code, aligning with RBI’s Fair Practices Code. So the same message, the push for growth should not come at the expense of customer well-being.”

She also raised an important issue regarding the role NBFCs can play in supporting the banking sector’s priority sector lending goals.

The minister pointed out that every year, a substantial amount of funds allocated for priority sector lending by banks remains unutilized. These unutilized funds are then transferred to institutions like NABARD and SIDBI.

“In the last few years, I have been closely monitoring how public priority sector lending activities of the banks are going on. Every year you have substantial amount left behind, which then gets refilled to NABARDs of the world and SIDBIs of the world,” Sitharaman said.

She questioned the logic behind returning these funds to financial institutions when they could be disbursed to the people who need them on the ground.

“Collectively, if you put together all the public sector banks, they have a certain number of branches all over the country. NABARD has far less than that. What’s the logic? Why should the priority sector lending money be coming back to the secretary? It should be in the ground with the people for whom it was meant,” she added.

The minister proposed that NBFCs, which often operate at the last mile, could be co-opted by banks as partners to improve the priority sector lending performance.

“Is there a role that you can actively play through the NBFCs? You and the NBFCs together. Because they are there at the last mile. Can the priority sector lending performance of the banks be improved if you co-opt the NBFCs as your partners in this?” she said.

Sitharaman also invited the Reserve Bank of India to offer guidance on how this partnership could be achieved without disrupting prudential norms.

She pointed out that the delay in disbursement, when funds return to NABARD or SIDBI and then are re-issued, causes a loss of six to eight months.

“Why should the customer at the end of the day, for whom the government is making this apportionment through the budget, not receive it that year itself?” she questioned.

She concluded by stating that the presence of NBFCs should be more effectively used by public sector banks to ensure timely and targeted credit delivery to the intended beneficiaries. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages